Streaming Wars – Part 1

Breaking down the (content) strategies of the streaming giants: Netflix, Amazon Prime Video, Disney Plus, AppleTV Plus and HBO Max.

7- minute read

I’m hyped and feel alive. Why? Baby Yoda and Jay-Z.

I’m also looking forward to 2020 a lot, as it will be an interesting year for streaming services. This is why:

- Big tech will spend more on scripted television this year than Canada or Australia spends on defense..Wow.

- Disney+ had over 10M sign-ups on the first day of its launch. Mickey Mouse voice: “Oh boy!”

- Spotify welcomed back Hova (Jay-Z), where he quickly amassed ~15M monthly listeners, of which approximately ~10M in the first week. Who says an artist can thrive without Spotify or Apple Music?

- Amazon Prime will continue its production of the Lord of the Rings series for a budget between $500M and $1.5B.

- HBO launches its streaming service: HBO Max, accompanied by a stupid change in brand strategy: preferring a vast catalog over high-quality scarce content.

- Streaming services seem to become a feature to existing products, meant to lock users in (Apple Music, Apple TV+, Amazon Prime) over stand-alone services.

In this blog post, I’m trying something new: sharing my thoughts on a specific subject. You guessed it, this time it’s streaming.

Today I want to break down Netflix content strategy and the strategies of the other streaming giants to see what we can learn. Also, I’m very curious about how local streaming services can survive this war, with small budgets and no ownership of blockbuster Hollywood movies and series.

So let’s dive in. How and where can each streaming service win?

Related: Streaming Wars – Part 2

Special thanks: Prof. Galloway

Netflix Content Strategy

Netflix

[nectar_dropcap color=”#1e83ec”]N[/nectar_dropcap]etflix has the first-mover advantage and has the largest content production budget ($13B), great technology and 159 million subscribers. Their core business? You guessed it: streaming content.

They seem to be in a good position to defend themselves against the competition from Big Tech. But they need to make great content to compete with the vast catalog of The Mouse, who owns Disney, Pixar, Marvel, Star Wars and National Geographic.

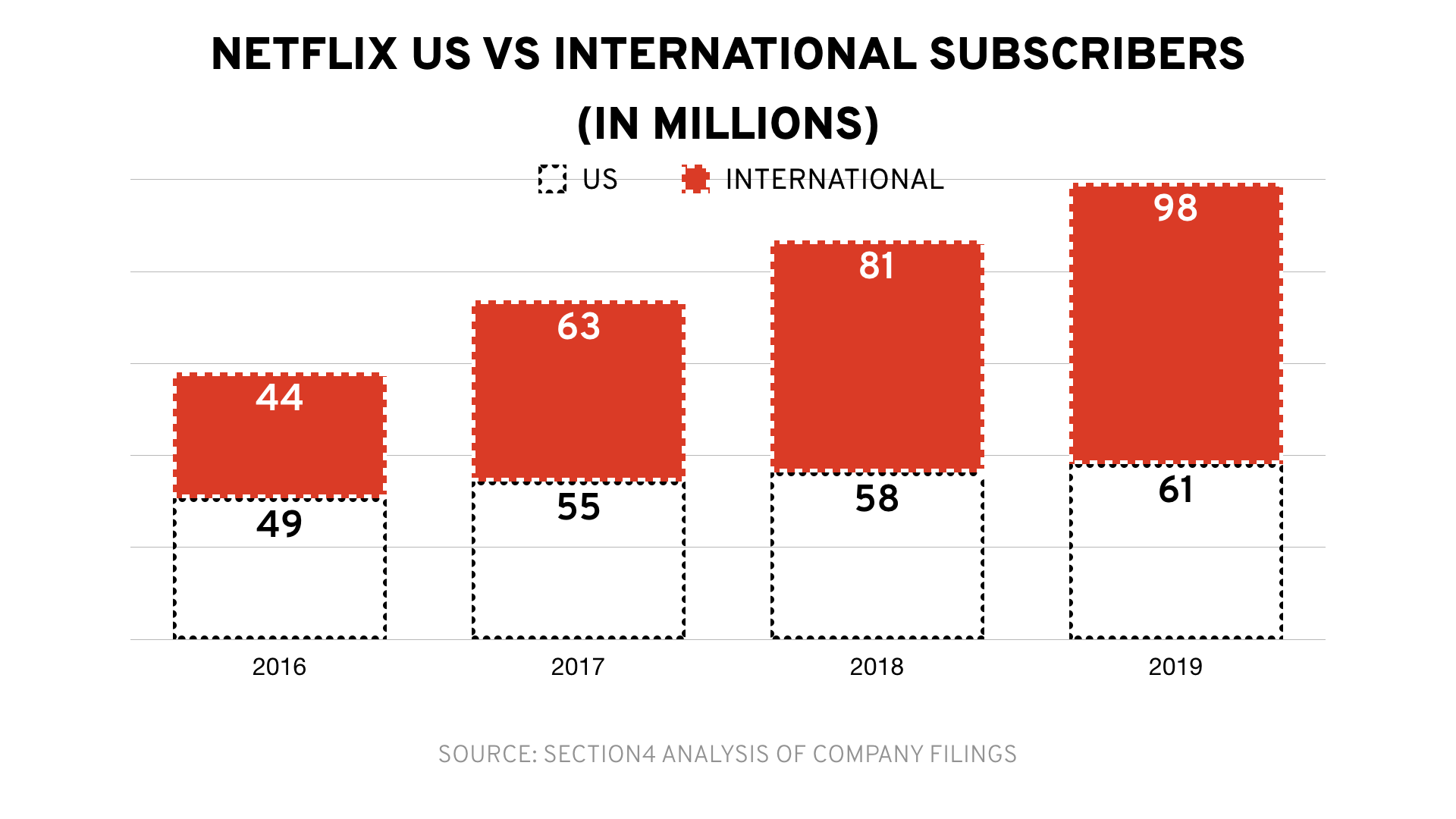

But how can Netflix grow? Over the last four years, US subs grew from 49M to 61M, and their international subs from 44M to 98M. 2019 recorded its lowest quarterly subscriber growth numbers in three years and its first US subscriber loss since 2011.

To continue on a path of growth, Netflix will need to go international and more local. And let’s be honest: Netflix needs to quickly become even better at original content production. Their current original programming failed to acquire enough new subs to meet their subscriber base targets.

Disney continues to show they understand the content production game, but it seems Netflix is a quick learner.

Goal

Subscriber Growth

Challenge

Slowing growth, license fees, loss of license deals

Netflix Content Strategy

Extensive catalog with more original content production based on data.

HBO Max Content Strategy

HBO Max

HBO (AT&T / WarnerMedia Entertainment) just made a shitty brand strategy move. This move could well damage their brand perception big time.

The brand strategy mistake is that HBO Max is going to compete with the deepest pockets in the world (Amazon Prime, Apple TV+, Netflix) who also have vertical integration with iPhones and Amazon Firesticks. By adding more content to the HBO Max catalog like Big Bang Theory (WarnerMedia content). Diluting the brand value of the HBO brand.

Consumers are increasingly becoming more selective in what they pay attention to, and HBO used to earn a disproportionate share of that attention. Now HBO Max chooses quantity over quality, instead of the other way around. Mediocre content and okay distribution make a weak value proposition.

Instead, HBO should keep playing the luxury card: high-quality scarce content and exclusively available via its own streaming services. Without the addition of WarnerMedia content. This makes an interesting additional streaming service for consumers and die-hard HBO fans.

HBO kept their brand strong in the last couple of decades, with shows like Game of Thrones, Westworld, The Sopranos, The Wire, etc. This was a strong value proposition.

HBO Max tries to play the game of Big Tech, while HBO can only win if they keep playing its own game which has a different set of rules.

Goal

HBO’s parent AT&T wants to be able to compete with streaming services

Challenge

Stay profitable and relevant in a changing media landscape.

HBO Max Content Strategy

HBO content is to bulk up WarnerMedia content.

Disney Plus Content Strategy

Disney+

The Mouse owns Disney, Pixar, Marvel, Star Wars and National Geographic. And above all, they own most of the shows that shaped our childhoods. From the original Aladdin, X-Men, Simpsons to Home Alone, Lion King and Alice in Wonderland.

Disney+ has years of experience in content production, a vast catalog of content and Baby Yoda’s (likable and ownable characters). Disney shows the world content is king, with their 10 million sign-ups on the first day.

According to Apptopia Disney’s average session length is +5.8% longer than Netflix and +7.8% longer than Amazonb Prime Video. We’ll have to see if those numbers keep up over a longer period.

And Netflix spent over 15 billion on content for the production of Netflix Originals (original content of movies and tv shows), vastly more than any other competitor in 2019.

Disney’s way to growth? Spotify/Netflix like partnerships with cable companies, to get better distribution. Their ultimate move? Vertical integration. Other good moves: exclusive content, both adding titles exclusively to Disney+ instead of movie theaters or adding shows on the service that you need to see before the next blockbuster movie of for instance Marvel. And don’t forget the nostalgia factor, market the sh*t out of nostalgic series to the right demographics for more sign-ups.

Goal

Transition to a subscription model.

Challenge

From a storytelling company to a tech company.

Disney+ Content Strategy

Blockbuster titles, with (exclusive) spin-offs and remakes.

Apple TV Plus Content Strategy

AppleTV+

We can keep it short here.

Apple needs to learn quickly. The Morning Show is produced for the same budget as Game of Thrones: $15M per episode, without the same impact on viewership or earned media output. Their show with Jason Mamoa nobody even talks about. Ouch.

So Apple+ needs to do a better job. They have big names like Oprah, Steven Spielberg, M. Night Shyamalan amongst others working with them. They’re in the pockets of 1.4 billion affluent shoppers (great distribution) and with their luxury brand status, they would be smart to double down on high-quality content.

Just imagine what can happen to Apple’s revenue if they keep adding an increasing amount of their 1.4 billion users for a $5 monthly subscription fee. For consumers, it’s just a couple of coffees a month. For Apple a $7B opportunity.

What do you think? Is their $1B investment worth the risk?

Learn more about how Apple’s focus on a frictionless experience drives AppleTV+ sign-ups.

Goal

Recurring revenue from other services as iPhone sales decrease.

Challenge

No catalog of popular library content to build its service on.

AppleTV+ Content Strategy

Bring you the best original stories from the most creative minds in television and film.

Amazon Prime Video Content Strategy

Amazon Prime Video

Prime Video is merely a perk within a broader ecosystem of services of Amazon’s Prime membership service.

$5 billion spend on original content (2018). Acquiring the rights to Lord of the Rings for $250 million, and the production budget for the LOTR series is estimated between $500M and $1,5B.

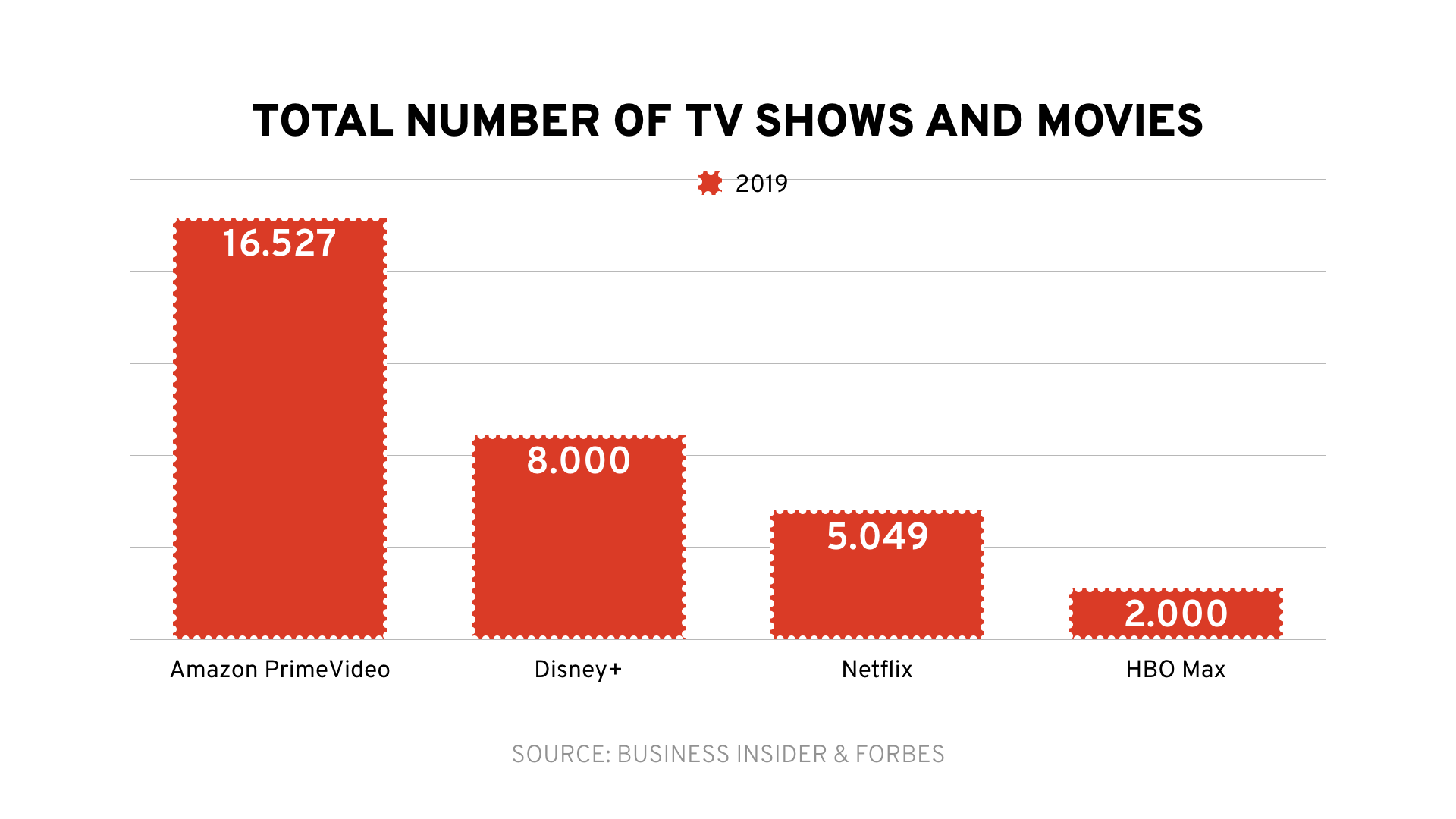

With the largest number of TV shows and movies in 2019, accompanied by good distribution and insane content production budget Amazon is in a good position to retain and acquire customers.

They quickly need to get better quality (award-winning) content. And they’ll quickly need to grow in international markets before Netflix, Apple or Disney overtakes these markets. For instance through better local partnerships with creatives and studios.

More on this topic: learn about friction, moats, and loyalty from the biggest and most successful companies in the world: Netflix, Disney, Apple, and Amazon.

Goal

Acquire and retain AmazonPrime users.

Challenge

Transitioning from longtail content strategy to original content.

Amazon Prime Video Content Strategy

Original local and global award-winning content.

Learnings from the Streaming Giants

#1 – Binge-watching vs. Weekly releases

Disney+ and HBO show that you can keep the audience engaged for a longer period and grow share of voice through weekly releases, compared to binge-watching.

Perfect example: Game of Thrones and The Mandalorian, more and more viewers start to watch as media piles on with good reviews and fans tell more and more of their network to watch. The noise around these shows lasts for months on end.

Compare this to the short run of Stranger Things, after about a month the noise around the show dies out. Imagine what binge-watching would have done for Thrones.

#2 – Brand Strategy & Value Proposition

HBO shows that if you don’t own a vast catalog of content, you can still win as long as your value proposition is on point. In their case: less is more. Taking on a luxury brand approach, where they create high-quality products and whilst keeping it scarce (weekly releases over binge-watching).

#3 – Nostalgia

Disney keeps building on existing fanbases for new shows. And Netflix quickly picks up on that as well with shows like Dark Crystal.

For all parties, there is still has a great opportunity to acquire and retain viewers: nostalgia content. Market it to the right demographics and fans will flock to your service and share it with their (social) networks.

What can local streaming companies do?

Either move quickly and bind the best local talents, acquire important content rights or pull an HBO-like luxury move. Or be prepared to lose subscribers. Like master, Yoda says: “Do or do not. There is no try.”

Read more: Streaming Wars – Part 2